Retiring Internationally with Social Security: Realistic Options and Costs

Introduction to Retiring Internationally

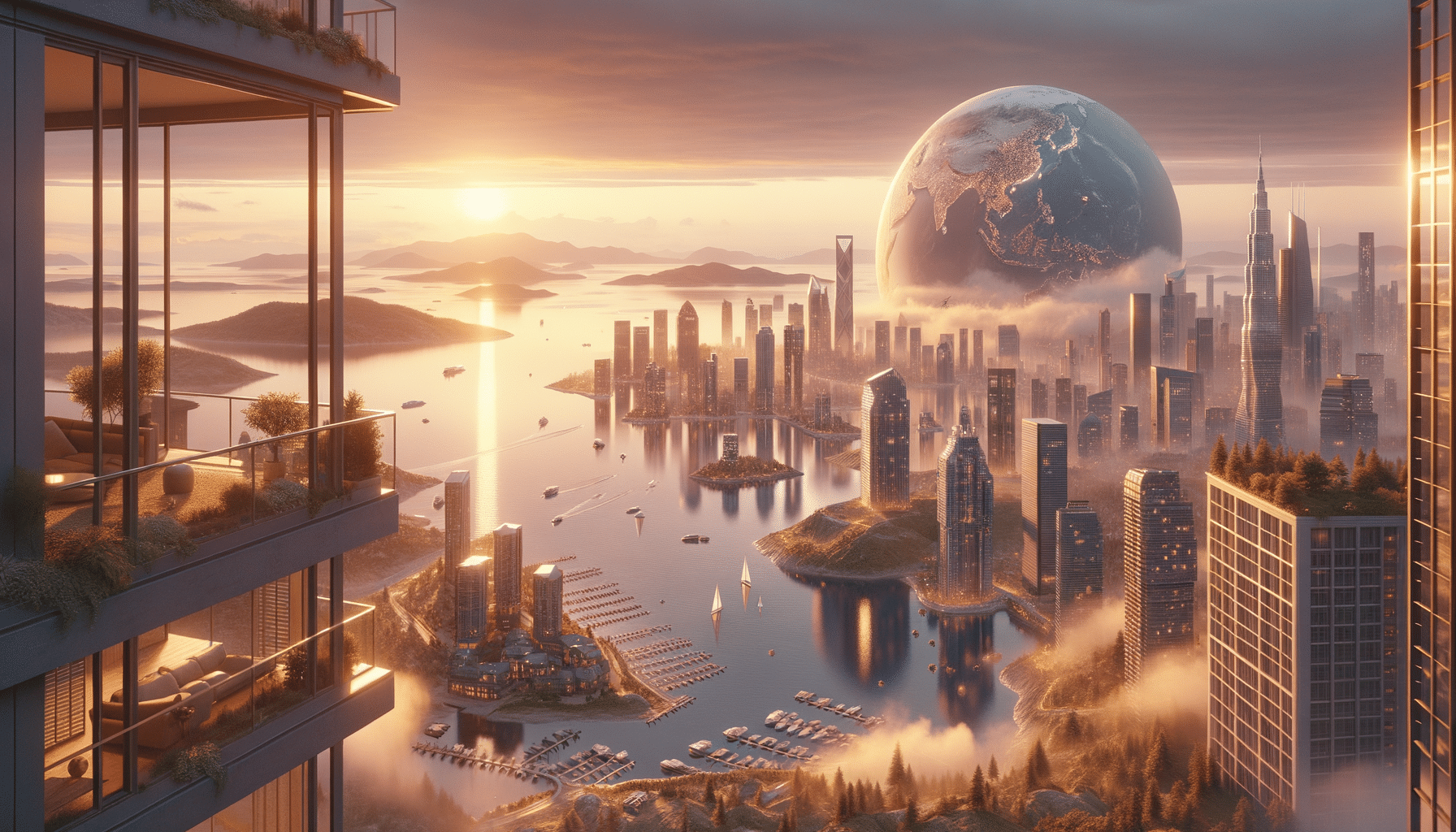

As the golden years approach, many retirees consider the prospect of spending their retirement abroad. The allure of new cultures, warmer climates, and potentially lower costs of living can be very appealing. However, retiring internationally requires careful planning, especially when relying on Social Security as a primary income source. This article explores the key considerations for those contemplating retiring abroad, ensuring a smooth transition and a comfortable lifestyle.

Choosing the Right Destination

When considering retiring internationally, selecting the right destination is crucial. Factors such as cost of living, healthcare quality, climate, and cultural experiences should be meticulously evaluated. Destinations like Portugal, Thailand, and Costa Rica have become popular among retirees due to their affordable living costs and pleasant climates. It is essential to research the specific regions within these countries, as costs and amenities can vary significantly.

Considerations for choosing a destination include:

- Healthcare facilities and access to medical care.

- Visa and residency requirements.

- Language barriers and cultural integration opportunities.

- Safety and political stability.

- Proximity to family and friends.

Exploring these factors will help ensure that the chosen destination aligns with personal preferences and financial capabilities.

Financial Planning and Social Security

Understanding the financial implications of retiring abroad is vital, particularly when relying on Social Security. It is important to determine how Social Security benefits will be affected by living in a foreign country. The Social Security Administration provides guidance on how benefits are calculated and paid to expatriates. Retirees should also consider the impact of exchange rates and the cost of transferring funds internationally.

Key financial planning steps include:

- Calculating the total cost of living in the chosen country, including housing, utilities, and daily expenses.

- Understanding tax obligations both in the U.S. and the host country.

- Exploring options for banking and currency exchange to minimize fees.

- Setting a realistic budget that accommodates unexpected expenses.

By carefully planning finances and understanding Social Security implications, retirees can enjoy a financially secure life abroad.

Creating a Retirement Lifestyle Abroad

Once the financial and logistical aspects are addressed, it is time to focus on creating a fulfilling retirement lifestyle abroad. Embracing the local culture and building a social network can significantly enhance the quality of life. Joining local clubs, participating in community events, and learning the local language are excellent ways to integrate into the new environment.

Consider these tips for a rewarding retirement lifestyle:

- Engage in volunteer opportunities to give back to the community.

- Pursue hobbies or activities that may have been postponed during working years.

- Stay connected with family and friends through regular communication and visits.

- Explore the local cuisine and traditions to enrich the cultural experience.

Ultimately, retiring internationally can offer a unique and enriching experience, provided that thorough research and planning are undertaken. By understanding the challenges and opportunities, retirees can enjoy a peaceful and fulfilling life abroad.